I. ABEST21 Accreditation System

1. Purpose of the ABEST21 Accreditation

The mission of a business school is to nurture world-class management professionals who can compete in the age of advanced technology, social, economic, and cultural globalization, and accelerated communication. To achieve the mission, it is indispensable to develop an education system at an internationally recognized level, accompanied by educational quality assurance. Therefore, quality assurance by a third party has been requested for ensuring not only the educational quality that the school is expected to provide, but also educational quality enhancement to the stakeholders of the school.

In order to respond to these needs, ABEST21 was founded on July 1, 2005, as an accreditation institution aiming to assure not only the educational quality but also educational quality enhancement expected from the school. ABEST21 is involved in not only the quality assurance of education but in building the education system which will be the base for enhancement of education quality in response to the change of environment.

In the age of globalization, business schools are responsible for nurturing capable management professionals who can contribute to world peace and prosperity, and the quality of business education is indispensable for achieving this aim. ABEST21 as an accreditation institution has to support business schools in realizing their mission by assessing the quality of their educational and research activities in a fair and objective manner. And we have to recognize our role for supporting the establishment of education system which provides enhancement of educational quality through promotion of PDCA cycle operation toward the future.

Thus ABEST21 Quality Assurance System aims to assess the system of management education quality enhancement in response to the changes of educational and research environment, in addition to education quality assurance.

On Tuesday, March 5, 2018, ABEST21 held the Accreditation Committee and the Peer Review Committee at Shinagawa Season Terrace Conference and accredited 8 schools as follows:

A: Professional Graduate School of Business in Japan

“Management”

- Department of Business Administration, SBI Graduate School, Japan

B: Management Accreditation in Asia

1. Program-based Accreditation System

“Master Program in Management”

- Faculty of Economics, Universitas Andalas, Indonesia

- Faculty of Economics and Business, Universitas Indonesia, Indonesia

- Faculty of Economics and Business, Universitas Kristen Satya Wacana, Indonesia

- Faculty of Business and Economics, Universitas Surabaya, Indonesia

“Master Program in Applied Economics”

- Faculty of Economics and Business, Universitas Padjadjaran, Indonesia

“Master Program in Accounting”

- Faculty of Economics and Business, Universitas Padjadjaran, Indonesia

2. Academic unit-based Accreditation System

- School of Business and Management, Institut Teknologi Bandung, Indonesia

2. The ABEST21 Peer Review System

The ABEST21 Peer Review System consists of three components.

1) Accreditation Committee

Chair

- Sudarso Kaderi Wiryono

Dean, School of Business and Management, Institut Teknologi Bandung, Indonesia

Vice Chair

- Yasunaga Wakabayashi

Dean, Graduate School of Management, Kyoto University, Japan - Mohd Ridzuan Darun

Dean, Faculty of Industrial Management, Universiti Malaysia Pahang, Malaysia - Takeshi Hibiya

Advisor, Fuji Xerox Co., Ltd., Japan

Members

- Candra Fajri Ananda

Professor, Faculty of Economics and Business, Universitas Brawijaya, Indonesia - Mutsuhiro Arinobu

Executive Director, RIKEN, Japan - Ilker Baybars

Dean and CEO Emeritus, Carnegie Mellon University-Qatar

Deputy Dean Emeritus, Tepper School of Business, Carnegie Mellon University, USA - Ming Yu Cheng

Professor, Faculty of Accountancy & Management, Universiti Tunku Abdul Rahman, Malaysia - AAhad Osman Gani

Dean, Graduate School of Management, International Islamic University Malaysia, Malaysia - Jun Kanai

Former President, Toshiba Human Resources Development Corporation, Japan - Mika Kumahira

President, Atech Kumahira Co., Ltd., Japan - Katsufumi Mizuno

Patent Attorney and President, Hikari Patent Office, Japan - Hisatsugu Kitajima

General Manager, Corporate Human Resources Division

Sony Corporate Services (Japan) Corporation, Japan - Tadashi Okamura

Honorary Advisor, Toshiba Corporation, Japan - Robert S. Sullivan

Dean, Rady School of Management, University of California San Diego, USA - Oleg Vikhanskiy

Dean, Lomonosov Moscow State University Business School, Lomonosov Moscow State University, Russia

2) Peer Review Committee

Chair

- Mohd Ridzuan Darun

Dean, Faculty of Industrial Management, Universiti Malaysia Pahang, Malaysia

Vice Chair

- Qinhai Ma

Dean, School of Business Administration, Northeastern University, China -

Ari Kuncoro

Dean, Faculty of Economics and Business, Universitas Indonesia, Indonesia - Yasunaga Wakabayashi

Dean, Graduate School of Management, Kyoto University, Japan - Azlan Amran

Dean, Graduate School of Business, Universiti Sains Malaysia, Malaysia

Members

- Ir. Noer Azam Achsani

Dean, School of Business, Institut Pertanian Bogor, Indonesia - Shigeru Asaba

Dean, Graduate School of Business and Finance, Waseda University, Japan - Siriwut Buranapin

Dean, Faculty of Business Administration, Chiang Mai University, Thailand - Yudi Azis

Dean, Faculty of Economics and Business, Universitas Padjadjaran, Indonesia - Hiroshi Fujiwara

Dean, Department of Business Administration, SBI Graduate School, Japan - AAhad Osman Gani

Dean, Graduate School of Management, International Islamic University Malaysia, Malaysia - Kazuo Ichijo

Dean, Graduate School of International Corporate Strategy, Hitotsubashi University, Japan - Chiaki Iwai

Dean, Graduate School of International Management, Aoyama Gakuin University, Japan - Abdul Rahman Kadir

Dean, Faculty of Economics and Business, Universitas Hasanuddin, Indonesia - Ali Khatibi

Dean, Graduate School of Management, Management & Science University, Malaysia - Nurkholis

Dean, Faculty of Economics and Business, Universitas Brawijaya, Indonesia - Nor’Azam Mastuki

Dean, Arshad Ayub Graduate Business School, Universiti Teknologi MARA, Malaysia - Vichayanan Rattanawiboonsom

Dean, Faculty of Business, Economics and Communications, Naresuan University, Thailand - Arumugam Seetharaman

Dean for Academic Affairs, S P Jain School of Global Management, Singapore - Zeljko Sevic

Dean, Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia, Malaysia - Suharnomo

Dean, Faculty of Economics and Business, Universitas Diponegoro, Indonesia - Eko Suwardi

Dean, Faculty of Economics and Business, Universitas Gadjah Mada, Indonesia - Sudarso Kaderi Wiryono

Dean, School of Business and Management, Institut Teknologi Bandung, Indonesia - Hua Xu

Program Chair, MBA Program in International Business, Graduate School of Business

Sciences, University of Tsukuba, Japan - Zulkornain bin Yusop

CEO & President, Putra Business School, Malaysia - Mohd Zaher Mohd Zain

Dean, Graduate School of Business, Universiti Kebangsaan, Malaysia

3) Peer Review Team

- Dr. Agus Fredy Maradona

Master of Management, Universitas Pendidikan Nasional, Indonesia - Prof. Dr. Ali Khatibi

Graduate School of Management, Management & Science University, Malaysia - Dr. Anis Chariri

Faculty of Economics and Business, Universitas Diponegoro, Indonesia - Principal Director Arfah Salleh, Ph.D.

Human Governance Institute INC., Malaysia - Dean Prof. Dr. Arumugam Seetharaman

S P Jain School of Global Management, Singapore - Dean Dr. Azlan Arman

Graduate School of Business, Universiti Sains Malaysia, Malaysia - Prof. Dr. Badri Munir Sukoco

Faculty of Economics and Business, Universitas Airlangga, Indonesia - Dr. Bernardinus Maria Purwanto

Faculty of Economics and Business, Universitas Gadjah Mada, Indonesia - Dr. Budiono

Faculty of Economics and Business, Universias Padjadjaran, Indonesia - Dr. Bukhshtaber Natalia

Lomonosov Moscow State University Business School, Lomonosov Moscow State University, Russia - Prof. Dr. Candra Fajri Ananda

Faculty of Economics and Business, Universitas Brawijaya, Indonesia - Prof. Dr. Christantius Dwiatmadja

Faculty of Economics and Business, Universitas Kristen Satya Wacana, Indonesia - Dr. Danaipong Chetchotsak

College of Graduate Study in Management, Khon Kaen University, Thailand - Dr. David Methé

Institute of Business and Accounting, Kwansei Gakuin University, Japan - Prof. Dr. David Paul Elia Saerang

Faculty of Economics and Business, Universitas Sam Ratulangi, Indonesia - Dr. Devika Nadarajah

Putra Business School, Universiti Putra Malaysia, Malaysia - Dr. Dodi Wirawan Irawanto

Faculty of Economics and Business, Universitas Brawijaya, Indonesia - Dean Dodie Tricahyono, Ph.D.

School of Economics and Business, Universitas Telkom, Indonesia - Prof. Dr. Eko Ganis Sukoharsono

Faculty of Economics and Business, Universitas Brawijaya, Indonesia - Dr. Fathyah Hashim

Graduate School of Business, Universiti Sains Malaysia, Malaysia - Prof. Dr. Gagaring Pagalung

Faculty of Economics and Business, Universitas Hasanuddin, Indonesia - Dr. Gunalan Nadarajah

Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia, Malaysia - Dr. Harryadin Mahardika

Faculty of Economics and Business, Universitas Indonesia - Dr. Harryanto bin Nyoto

Faculty of Economics and Business, Universitas Hasanuddin, Indonesia - Dr. Hen Kai Wah

Faculty of Accountancy and Management, Universiti Tunk Abdul Rahman, Malaysia - Prof. Hideki Ishikawa

Department of Business Administration, SBI Graduate School, Japan - Prof. Dr. Hirotaka Kawano

Graduate School of Management, Kyoto University, Japan - Prof. Hiroshi Takamori, Ph.D.

School of Accounting, LEC Graduate University, Japan - Prof. Dr. Huang Lin

Graduate School of Business Administration, Kobe University, Japan - Prof. Dr. Ibrahim Kamal Abdul Rahman

Universiti Kuala Lumpur Business School, Universiti Kuala Lumpur, Malaysia - Dr. Ida Binti MD Yasin

Purta Business School, Universiti Putra Malaysia, Malaysia - Dr. Idqan Fahmi

School of Business, Institut Pertanian Bogor, Indonesia - Dr. Irwan Trinugroho

Faculty of Economics and Business, Universitas Sebelas Maret, Indonesia - Dr. Irina Petrovskaya

Lomonosov Moscow State University Business School, Lomonosov Moscow State University, Russia - Dr. Jaafar Pyeman

Arshad Ayub Graduate Business School, Universiti Teknologi MARA, Malaysia - Prof. Hirotaka Kawano

Graduate School of Management, Kyoto University, Japan - Dr. Prof. Lizar Alfansi

Faculty of Economics and Business, Universitas Bengkulu, Indonesia - Dr. Masyhuri Hamidi

Faculty of Economics, Universitas Andalas, Indonesia - Prof. Dr. Ming Yu Cheng

Faculty of Accountancy and Management, Universiti Tunku Abdul Rahman, Malaysia - Dean Dr. Mohd Ridzuan Darun

Faculty of Industrial Management, Universiti Malaysia Pahang, Malaysia - Dr. Mohd Zaher Mohd Zain

Graduate School of Business, Universiti Kebangsaan Malaysia, Malaysia - Dr. Nisful Laila

Faculty of Economics and Business, Universitas Airlangga, Indonesia - Dr. Noorihsan Bin Mohamad

Faculty of Economics and Management Sciences, International Islamic University Malaysia, Malaysia - Dean Dr. Norazam Bin Mastuki

Arshad Ayub Graduate Business School, Universiti Teknologi MARA, Malaysia - Dr. Noryati Ahmad

Arshad Ayub Graduate Business School, Universiti Teknologi MARA, Malaysia - Dr. Pichayalak Pichayakul

Faculty of Business Administration, Chiang Mai University, Thailand - Dr. Popy Rufaidah

Faculty of Economics and Business, Universitas Padjadjaran, Indonesia - Dr. Putu Anom Mahadwartha

Faculty of Business and Economics, Universitas Surabaya, Indonesia - Dean Prof. Dr. Qinahi Ma

School of Business Administration, Northeastern University, China - Dr. Rapeeporn Srijumpa

Graduate School of Commerce, Burapha University, Thailand - Dr. Remy Magnier Watanabe

MBA Program in International Business, Graduate School of Business Sciences,

University of Tsukuba. Japan - Prof. Emeritus Dr. Richard Taggart Murphy

University of Tsukuba. Japan - Dr. Reza Nasution

School of Business and Management, Institut Teknologi Bandung, Indonesia - Dr. Sahid Susilo Nugroho

Faculty of Economics and Business, Universitas Gadjah Mada, Indoensia - Prof. Dr. Shahizan Bin Hassan

Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia, Malaysia - Dean Dr. Sia Bee Chuan

Faculty of Accountancy and Management, Universiti Tunk Abdul Rahman, Malaysia - Prof. Shigeki Sadato

Institute of Business and Accounting, Kwansei Gakuin University, Japan - Dean Dr. Siriwut Buranapin

Faculty of Business Administration, Chiang Mai University, Thailand - Dr. Siti Zahela Sahak

Arshad Ayub Graduate Business School, Universiti Teknologi MARA, Malaysia - Dr. Sri Gunawan

Faculty of Economics and Business, Universitas Airlangga, Indonesia - Dean Prof. Dr. Sudarso Kaderi Wiryono

School of Business and Management, Institut Teknologi Bandung, Indonesia - Dean Dr. Suharnomo

Faculty of Economics and Business, Universitas Diponegoro, Indonesia - Dr. Sujinda Chemsripong

Faculty of Business, Economics and Communications, Naresuan University, Thailand - Prof. Takao Shigeta

Department of Business Administration, SBI Graduate School, Japan - Prof. Dr.Takayuki Asada

Faculty of Business Administration, Ritsumeikan University, Japan - Prof. Tatsuyuki Negoro

Graduate School of Business and Finance, Waseda University, Japan - Dean Prof. Dr. Taufiq Marwa Rahmat

Faculty of Economics, Universitas Sriwijaya, Indonesia - Dr. Tee Keng Kok

School of Business, Monash University Malaysia Sdn. Bhd., Malaysia - Dr. Tengku Ezni Balqiah

Faculty of Economics and Business, Universitas Indonesia, Indonesia - Prof. Dr. Utomo Sarjono Putro

School of Business and Management, Institut teknologi Bandung, Indonesia - Prof. Dr. Ujang Sumarwan

School of Business, Institut Pertanian Bogor, Indonesia - Dean Dr. Yudi Azis

Faculty of Economics and Business, Universitas Padjadjaran, Indonesia - Prof. Dr. Yutaka Kakeda

School of Cultural and Creative Studies, Aoyama Gakuin University, Japan - Dr. Zabeda Bt. Abdul Hamid

Graduate School of Management, IIUM Academy, Malaysia - Dean Prof. Dr. Yasunaga Wakabayashi

Graduate School of Management, Kyoto University, Japan - Dr. Yasmine Nasution

Faculty of Economics and Business, Universitas Indonesia, Indonesia

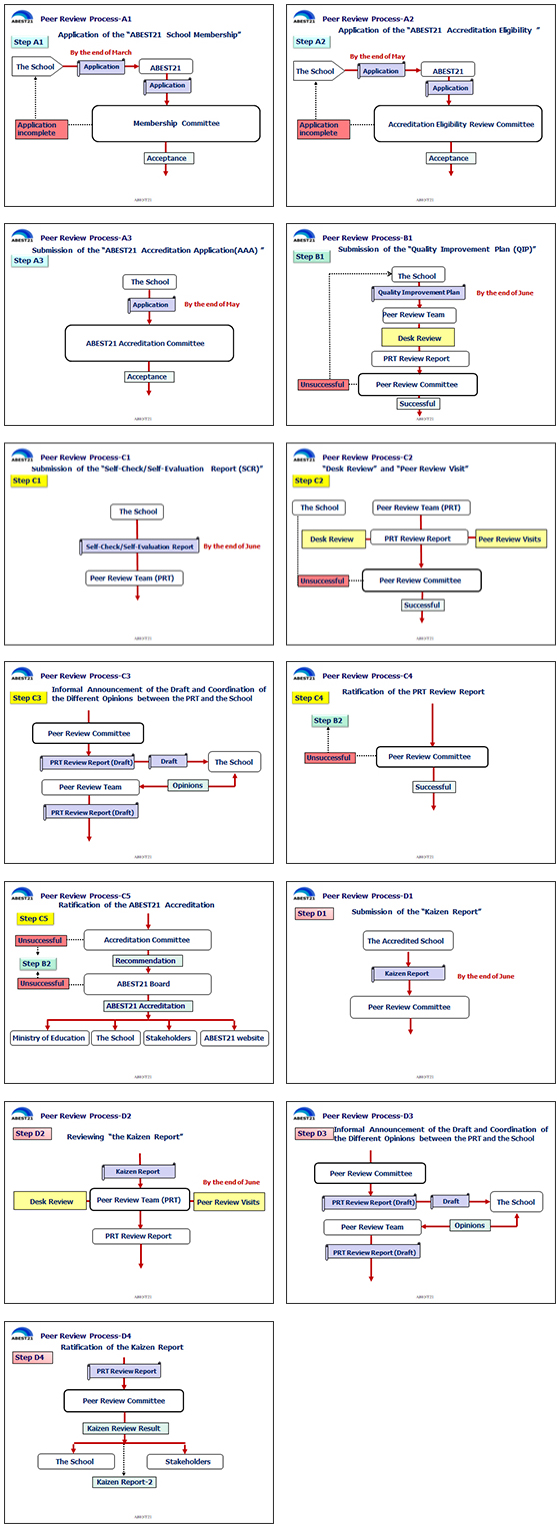

3. The ABEST21 Accreditation Process

Step A: Applying to the ABEST21 Accreditation.

- Step A1: Application for the “ABEST21 School Membership”

The School has to become a full-school member of ABEST21 when it applies for the ABEST21 Accreditation. - Step A2: Application for the “ABEST21 Accreditation Eligibility”

When the School applies for ABEST21 Accreditation, it has to obtain a qualification for the ABEST21 Accreditation Application. The School submits the completed Accreditation Eligibility

Application to the ABEST21. - Step A3: Submission of the “ABEST21 Accreditation Application”

The School submits the ABEST21 Accreditation Application to the ABEST21. Upon receiving the application, the School has to prepare to submit the “Quality Improvement Plan” immediately.

Step B: Reviewing the “Quality Improvement Plan (QIP)”

The School submits its QIP. If the QIP is successful, the School will proceed to preparation of Self-Check/Self-Evaluation Report, and the unsuccessful School will resubmit the QIP.

Step C: Reviewing the “Self-Check/Self-Evaluation Report (SCR)”

The School submits its SCR. In preparing the Report, the School conducts the self-check based on the basic and detailed perspectives of the accreditation standards with the support of the advisory team.

- Step C2: “Desk Review” and “Peer Review Visit”

The Peer Review Committee entrusts the Peer Review Team (PRT) of the School with the review of the Self-Check/Self-Evaluation Report. The PRT conducts the Desk Review and the Peer Review Visit. - Step C3: Informal announcement of the Draft of the PRT Review Report

The PRT informally announces the Draft of the PRT Review Report to the School, providing an opportunity for the School to give its comments or objections. If any objection

is raised by the School, the Peer Review Team shall conduct a factual survey and coordinate the statement. - Step C4: Ratification by the PRT Review Report

Based on the coordination of opinions between the School and the PRT, the PRT reports the Draft to the Peer Review Committee. The Committee reviews it and decides on the recommendation to the Accreditation Committee. - Step C5: Ratification of the ABEST21 Accreditation

The Accreditation Committee shall examine the Draft Recommendation for accreditation submitted by the Peer Review Committee and deicide by vote whether to submit it to the Board of Trustees.

Based on the recommendation of the Accreditation Committee, the Board of Trustees reviews the recommendation and finalizes the accreditation. The accreditation result is reported to the stakeholders after the ratification by the Board of Trustees.

Step D: Reviewing the Kaizen Report

- Step D1: Submission of the Kaizen Report

The accredited School submits the Kaizen Report for the previous school year by the end of June every year. The Report clarifies the progress achieved in resolving the Kaizen issues based on the action

plans analyzed in the SCR. - Step D2: Reviewing the Kaizen Report

ABEST21 will have the School’s Peer Review Team review the Kaizen Report and its correspondence with the action plan, and prepare the Kaizen Review Report. The Peer Review Committee entrusts the Peer Review

Team (PRT) of the School with the review of the Kaizen Report. PRT conducts document review and peer review visit and informally announces the draft of the recommendation to the School, providing an opportunity for the School to give its comments

or objections. If any objection is raised by the School, the Peer Review Team shall conduct a factual survey and coordinate the statement. - Step D3: Informal Announcement of the Draft of the Kaizen Review Report to the School

The PRT submits the Kaizen Review Report to the Peer Review Committee. The Peer Review Committee examines the coordinated Draft Recommendation based on the

feasibility of the action plan and the effectiveness of the quality maintenance and improvement of education. The result is reported to the stakeholders. - Step D4: Ratification of the Kaizen Report

The PRT submits the Kaizen Review Report to the Peer Review Committee. The Peer Review Committee examines the coordinated Draft Recommendation based on the feasibility of the action plan and the effectiveness of the quality maintenance and improvement of education. The result is reported to the Accreditation Committee.

Accreditation Committee shall examine the Draft Recommendation submitted by the Peer Review Committee and decide whether to submit it to the Board of Trustees. And, based on the recommendation of the Accreditation Committee, the Board of Trustees reviews the recommendation and ratifies the report. The Kaizen Review Report is reported to the stakeholders after the ratification

by the Board of Trustees.

4. ABEST21 Accounting Accreditation Standards

CHAPTER ONE: MISSION STATEMENT

Standard 1-MISSION STATEMENT

“Any School which applies for management accreditation by ABEST21 (hereinafter called “the School”) must define a mission statement for its educational and research activities that provides a framework for how decisions are made by the School’s management.

- “The School must stipulate a mission statement.”

- “The School must develop its mission statement with the aim of nurturing highly skilled professionals in accounting who are able to play an active role in the arena of a globalized competition.”

- “The School’s mission statement must be a statement that reflects the views of its stakeholders.”

- “The School must publish itsmission statement in brochures, such as its School code, student admission materials, syllabi, and program outlines, and post its mission and goals on the School’s website.”

- “The School’s mission statement must be a statement which

includes developing expert knowledge, fundamental knowledge and sophisticated expertise in the realm of management.”

Standard 2-MISSION IMPERATIVES

“The School’s mission statement must imply nurturing highly skilled professionals in accounting and bear part of the larger mission of the parent university.”

- “The School’s mission statement must imply nurturing highly skilled accounting professionals who plays an active role in the globalized competition.”

- “The School’s mission statement must bear part of the larger mission of the parent university.”

- “The School’s mission statement must be a statement

which includes developing expert knowledge, fundamental knowledge and sophisticated expertise in the realm of accounting .” - “The School’s mission statement must be a statement that indicates the support of the students’ career development.”

- “The School’s mission statement must be a statement that indicates contribution to the development of the educational and research activities of its faculty members.”

Standard 3-OBJECTIVES FOR CONTINUOUS IMPROVEMENT

“The School must review its mission statement periodically based on the defined processes which ensure continuous improvement of its mission statement in response to the changes in its educational and research environment.”

- “The School must have systematic decision-making processes for reviewing its mission statement.”

- “The School must review its mission statement periodically based on the defined processes.”

- “The School must form an operational control framework to gather and file relevant information and data in order to review its mission statement on a regular basis.”

- “The School must establish the framework for seeking the opinions of stakeholders on reviewing its mission statement continuously.”

Standard 4-FINANCIAL STRATEGIES

“The School must have both short-term and long-term financial strategies to raise necessary funds to realize its mission statement.”

- “The School must have a financial basis necessary for realizing its mission statement.”

- “The School must develop financial strategies for raising the funds necessary for realizing its mission statement.”

- “The School must take appropriate action to secure adequate budgets necessary for realizing its mission statement.”

CHAPTER TWO: EDUCATIONAL PROGRAMS

Standard 5-LEARNING GOALS

“The School must define its learning goals which imply innovation and discovery, global engagement, and diffusion of technology for realizing its mission statement.”

- “The School must define its learning goals for its educational programs.”

- “The School must publish its learning goals in brochures, such as its School code, student admission materials, syllabi, and program outlines, and publicize them to its students.”

- “The School must provide academic assistance to students in choosing the courses in line with their learning objectives, in accordance with the course registration guidelines defined by the School.”

- “The School must build a system to enhance communication among students, faculty,

and staff, and provide academic assistance to students to help them achieve their goals.”

Standard 6-MANAGEMENT OF CURRICULA

“The School must design its curriculum systematically to realize its mission statement.”

- “In designing its curriculum, the School must include core courses to provide a foundation necessary for accounting education and research.”

- “In designing its curriculum, the School must aim at helping students acquire expertise, advanced professional skills, advanced levels of scholarship, high ethical standards, and a broad international perspective which are necessary for accounting professionals.”

- “In designing its curriculum, the School must pay attention to combining theory and practice effectively in line with its mission statement and following the current trends in accounting education and

research.” - “The School must set a process to review its curriculum systematically and update its curriculum periodically.”

- “The School must design a system which enables its students to take related courses in other departments at the same university and at other universities, a credit transfer system with other schools, and a system to allow students to receive academic credit by completing an internship program.”

- “The School must utilize appropriate educational methods, including case studies, site surveys, debates, discussions, and question and answer sessions between faculty members and students and / or among students.”

- “When the School provides distance education, it must aim to maximize its educational effect by utilizing various media.”

Standard 7-EDUCATIONAL LEVEL

“The School must set the quality level of educational content so as to enable students to achieve their learning goals.”

- “The School must provide an environment and a guidance system that is conducive to learning and teaching in order

to maintain the quality level of educational content.” - “The School must secure adequate classroom hours necessary for completing one credit of each course in order to maintain the quality level of educational content.”

- “The School must design adequate time schedules and set a limit to the number of credits which students can take to assure students’ learning efficiency in order to maintain the quality level of educational content.”

- “The School must establish clearly defined standards for calculating grades and for evaluating the academic performance of its students, state them in its School code, and inform the students of them in order to maintain the quality level of educational content.”

- “The School must take measures that ensure that the completion of the program and the academic performance of students are evaluated fairly, and that grades are calculated in an objective and standardized way in order to maintain the

quality level of educational content.” - “The School must set a quota on the number of students registered to a course in accordance with its educational methods, the availability and condition of its facilities, and other educational considerations in order to maintain the quality level of educational content.”

- “The School must provide adequate registration guidance, learning guidance and academic and career guidance to respond to the needs of diversified student body including foreign students in order to maintain the quality level of educational content.”

- “The School’s faculty members should share information about students’ course records, attendance rates for each program, total credits earned and academic grades, and develop initiatives to improve students’ learning in order to maintain the quality level of educational content.”

- “In case of providing shortened programs, the School must ensure that the educational methods and time schedules enable the students to achieve its learning goals in order to maintain quality level of education.”

- “The School must provide sufficient support for the students taking distance education programs in order to maintain the quality level of educational content.”

Standard 8-MEASURES TO IMPROVE EDUCATIONAL QUALITY

“The School must improve its educational program quality in a systematic manner to realize its mission statement.”

- “The School must review its learning outcome systematically and periodically in order to improve its educational program quality.”

- “The School must prepare syllabi which state its educational goals, course contents, course plans, educational methods, class materials, faculty office hours, and standards for evaluating academic performance, and disclose the syllabi.”

- “The School must review the contents and practices of its syllabi in a systematic manner.”

- “The School must review its curriculum quality by both examining students’ course records, total credits earned, academic grades and career options, and reviewing opinions from stakeholders.”

- “The School must do periodic self-check/self-evaluations and publicize the results.”

- “The School must conduct faculty development/staff development in a systematic manner in order to improve its educational program quality.”

- “The School should establish a system for awarding faculty members who achieve distinguished teaching and research results in order to ensure

high quality of education and research.”

CHAPTER THREE: STUDENTS

Standard 9-STUDENT PROFILEY

“The School must specify the target student population and profile of its students to realize its mission statement.”

- “The School must specify the target student population and profile of its students.”

- “The School must make efforts to secure students with target profiles through its selection processes.”

- “The School must provide opportunities for the candidates to take entrance examinations in a fair and unbiased way.”

- “The School must update its target student profile periodically to meet the requirements of the School’s admission policy.”

- “The School must take measures to attract a diverse student body that possesses a variety of backgrounds and values to meet the needs of globalization.”

Standard 10-STUDENT ADMISSION

“The School must clearly stipulate its admission policy in its selection processes.”

- “The School’s admission policy must be a policy to accept students with target profiles.”

- “The School must clearly articulate its admission policy and selection criteria in brochures such as student admission materials and show them to all prospective candidates.”

- “The School must evaluate the scholastic abilities and aptitudes of candidates in a consistent and objective fashion through its selection processes.”

- “The School must match the actual number of student enrollment with the required enrollment through its selection processes.”

- “The School must review the needs of its target student profile periodically to secure the necessary number of students.”

Standard 11-STUDENT SUPPORT

“The School must have appropriate student support systems that help students concentrate on their academic work.”

- “The School must take various measures to provide financial support to students who need it.”

- “The

School must have administrative offices which collect and process relevant information and provide consultation for the students concerning academic guidance and career development.” - “The School must establish support systems to provide academic counseling and any other support that students require.”

- “The School must provide appropriate academic support and lifestyle support to international students and disabled students.”

Standard 12-STUDENT INCENTIVE

“The School must take measures to enhance the academic progression of its students to realize its mission statement.”

- “The School must have a system that rewards students who achieve excellent academic results.”

- “The

School must have a system for providing academic support to the students who face difficulties with continuing their studies.” - “The School must hold orientation programs at the time students enter the School, before the new academic year begins, or when the curriculum is updated, to provide incentives for students to achieve high standards of academic work.”

CHAPTER FOUR: FACULTY

Standard 13-FACULTY SUFFICIENCY

“The School must maintain an adequate faculty organization to realize its mission statement.”

- “The School must have a number of participating faculty members that is adequate for its educational programs.”

- “The School must maintain a sufficient number of full-time Professors and/or Associate Professors for the courses in the educational programs.”

- “The School must secure adequate number of practically qualified faculty members.”

- “The School must ensure that the ratio of full-time and part-time faculty members in its faculty organization is appropriate.”

- “The School must maintain faculty diversity in terms of age and gender.”

- “The School must maintain faculty diversity to meet the needs in the age of globalization.”

Standard 14 –FACULTY QUALIFICATIONSY

“The School must hire faculty members who possess intellectual qualifications, relevant expertise and teaching skills necessary for realizing its mission statement.”

- “The School must maintain qualified participating faculty members for each of the majors it offers in accordance with the following criteria:

- Faculty members recognized as possessing outstanding accomplishments in research or education;

- Faculty members recognized as possessing outstanding skills

in their field of study; - Faculty members recognized as possessing outstanding knowledge and experience in their field of study.”

- “The School must set rules and standards for recruiting and promotion of faculty members.”

- “The School must have a promotion system for faculty members and evaluate each faculty member fairly and objectively through this system.”

- “The School must periodically assess its faculty members by reviewing their

educational and research performance during the last five years.” - “The School must disclose information about the educational and research performance of participating faculty members during the previous five years.”

- “The School must evaluate academic performance of professional faculty members periodically, and assign the courses which they teach appropriately.”

Standard 15-FACULTY SUPPORT

“The School must have an educational and research environment necessary for promoting educational and research activities of its faculty members.”

- “The School must limit the number of courses its faculty members teach so that faculty members can secure time to develop their educational and research activities.”

- “The School must have a support system to secure the research funds necessary for promoting faculty members’ educational and research activities.”

- “The School must have a support system including administrative and technical support staff necessary for promoting faculty members’ educational and research activities.”

- “The School must take appropriate steps to vitalize its educational programs so as to promote the educational and research activities of its faculty.”

Standard 16-RESPONSIBILITIES OF FACULTY MEMBERS

“The School must ensure that the faculty members strive to communicate with its stakeholders and that their research and teaching activities are aimed at achieving the School’s mission statement.”

- “The School must ensure systematically that the faculty members continuously develop and improve their course contents, materials used in their courses, and teaching methods based on the results of the self-check/self-evaluation and the student evaluation.”

- “The School must ensure systematically that the faculty members strive to teach cutting-edge expertise and specialized knowledge in their respective fields of study in order to achieve the learning goals.”

- “The School must ensure systematically that the faculty members set office hours and actively communicate with the students through e-mail in order to help them to achieve their learning goals.”

CHAPTER FIVE: SUPPORTING STAFF AND INFRASTRUCTURE

Standard 17-EDUCATIONAL RESPONSIBILITIES OF STAFF

“The School must have an appropriate administrative system to support educational and research activities of its faculty members in order to realize its mission statement.”

- “The School must institute management systems, including faculty meetings and executive committees, to discuss administrative issues and to make and enforce the decisions required to achieve its mission statement.”

- “The School must institute administrative systems which are in an appropriate

proportion to its size and status.” - “The School must institute administrative systems which are able to respond to the needs of globalization.”

- “The School must institute administrative systems that adequately support

the educational and research activities of its faculty members.”

Standard 18-INFRASTRUCTURE SUPPORT

“The School must maintain educational and research facilities and other infrastructure needed to achieve its mission statement.”

- “The School must maintain an appropriate number and quality of its facilities, such as classrooms, seminar rooms, and study rooms, in order to enhance the efficiency of its educational programs.”

- “The School must provide an office for faculty members to prepare for class, especially an individual office for each full-time member.”

- “The School must systematically maintain a collection of books, academic journals, and audiovisual materials necessary for the educational and research activities of both students and faculty.”

- “The School must effectively utilize and maintain facilities and equipment appropriate for its educational and research activities and the delivery of its educational programs.”

- “The School must provide study environments which enable students to engage in self-study, and encourage students to make use of these environments.”

II. The Peer Review Team Comprehensive Evaluation

1. PRT Quality Assurance Evaluation

1) The School’s Mission Statement

Vision, mission, goals and objectives of the Master of Accounting (MAKSI) program are aligned with the vision, mission and objectives of Padjadjaran University (UNPAD), Faculty of Economics and Business (FEB) and the Department of Accounting. Vision, mission and objectives of MAKSI were developed through workshops involving stakeholders from the faculty level and also from the Department of Accounting, which includes the study program administrators, lecturers, representatives of alumni and students. Renewals of the statements was conducted in 2009 and last refurbished in 2012. The process of change included brainstorming and discussion while taking into consideration current conditions and future challenges facing the Master of Accounting (MAKSI) program at FEB UNPAD.

The vision and mission of the study program were developed by taking into consideration the input, process and output. Inputs include organizational competence, the quality of the resources (educators and administrators), as well as qualified prospective students. These inputs act as foundation for the implementation of quality learning process, academic services, and administrative services, to generate output graduates who have professional skills, high adaptability to change, and are expected to be globally competitive.

The Master of Accounting Program at FEB UNPAD has the following vision and mission statements:

Vision Statement:

Become an excellent master degree in accounting with high reputation & internationally recognized in 2026.

Mission Statements:

- Developing graduates who are competent in the field of accounting in accordance with the worldwide demands of professional accountants.

- Improving the competence and commitment of the academics who play an active role in the development of applied accounting knowledge and technology on a National and Asia Pacific level.

- Delivering internationally competitive higher education that is able to meet the world’s demands of human resources in accounting.

- Organizing higher education management with qualities that correspond to the principles of good governance to enhance the reputation and the trust of stakeholders.

In accordance with the first mission statement, the purpose of the Master of Accounting program is to prepare quality professionals in the field of accounting who are competent & ethic in the local, national and international perspective.

In accordance with the second mission statement, the purpose of the Master of Accounting program is to make a significant contribution to problem solving, either within the government and other not for profit organization, corporation, or among professionals, by developing professional accountants who can work locally, nationally and internationally.

In accordance with the third mission statement, the program aims to support education and development of professional accountants in applied accounting science which is recognized at the local, national and international levels.

Lastly, in accordance with the fourth mission statement, the purpose of the Master of Accounting program is to implement good governance in higher education management, contribute to building good education management, and at the same time gain public trust.

2) The School’s Educational System

The Master of Accounting system includes several key elements, such as the qualifications of prospective students, curriculum, teaching methods, the faculty team, assessment system, thesis and exams, and academic environment. The Master of Accounting system is developed with reference to the applicable regulations and standards as well as strategic goals of the study program.

Prospective students are the graduates from bachelor programs in accounting and non-accounting fields, who meet the criteria and passed the acceptance tests for new students. Test components include S1-academic scores, TOEFL or TOEFL-Like, and interview scores. Interview questions include topics related to motivation, purpose, and the initial draft of the research proposal.

The faculty team at the The Master of Accounting program consists of permanent faculty lecturers (Professors or Doctors and Masters) as well as practitioners who have expertise in their field of work. The area of expertise of lecturers is assessed based on the disciplines that the lecturer teaches in undergraduate programs, topics of research and community service work, and/or fields associated with their work in the practical world.

The MAKSI curriculum is developed based on national standard work load. Starting 2017, MAKSI adopted a new curriculum, whereby to complete all the requirements to graduate the students need to accumulate 37 credits. These 37 credits are divided into three categories:

- 15 credits of core (compulsory) courses

- 14 credits of optional (concentration) courses

- 8 credits of seminar and thesis writing.

Under the old requirements the students had to accumulate 46 credits. These 46 credits were divided into three categories:

- 20 credits of core (compulsory) courses

- 19 credits of optional (concentration) courses

- 6 credits of seminar and thesis writing.

One credit is equivalent to 50 minutes class meeting, 50 minutes of structured assignment, and 50 minutes of independent activity. Therefore, for a course with 3 credits is equivalent to 150 minutes of the above activities. For weekly normal workload, a full-time student can take 12-15 credits per semester.

The normal duration for the study in MAKSI is 18-24 months. According to national regulations, students have the opportunity to take maximum duration of study for 8 semesters, including thesis examination.

Students in The Master of Accounting program begin with matriculation as a bridging course for students whose undergraduate background is not in the field of accounting. Matriculation courses amount to 0 credits. Classes from semesters 1 to 3 are held through face to face lectures. Thesis writing can be started from the middle of the 3rd semester or the beginning of the 4th semester at the latest. The thesis can be completed throughout one or more semesters.

The learning system is a blend of tutorials and seminars. But most of the learning is held through seminars as a form of applying active student learning system.

In addition to conducting face to face lectures and thesis writing, in an effort to improve the quality of graduates the program also seeks to provide insights regarding scientific developments and current practical issues. The program also aims to increase research insights, including research methodology or publications, in the form of organizing public lectures, discussions and conferences.

The development of academic environment is implemented through plans and strategies, as well as by working with and/or aligning with the activities carried out by other study programs, the department, the faculty or university. To improve the quality of graduates’ competence in terms of soft skills, the study program seeks to create an ethical academic atmosphere, including a ban for students to cheat during exams and plagiarize in the thesis writing process. Students are obliged to prepare a letter stating that the thesis is not the result of plagiarism. There is also a ban on smoking in or around the campus area.

To graduate, the students are required to pass all courses, the thesis proposal defense and the thesis defense, and have a minimum GPA of 3.0. Both seminar and thesis defense are examined by 5 lectures including 2 supervisors.

Grading system for all study programs in the university must use the same scale as shown in the Table 1.

Table 1 University Partners

| Final Score (FS) | Grade | Grade Index |

| 80 ≤ FS ≤ 100 | A | 4 |

| 68 ≤ FS < 80 | B | 3 |

| 56 ≤ FS < 68 | C | 2 |

| 45 ≤ FS < 56 | D | 1 |

| FS < 45 | E | 0 |

3) The School’s Educational Degree Programs

Master of Accounting offers concentrations in accordance with the expertise of accounting professionals and the availability of human resources (lecturers).

Concentrations offered in the old and the new curricula are shown in Table 2.

Table 2

| Old curricula | New curricula |

|

1. Auditing & Financial Reporting 2. Governmental Accounting 3. Management Accounting 4. Taxation Accounting 5. Information System 6. Sharia/Islamic Accounting 7. Accounting science |

1. Financial Reporting 2. Governmental Accounting 3. Management Accounting 4. Taxation Accounting 5. Information System 6. Sharia/Islamic Accounting 7. Accounting science 8. Auditing |

In the new curricula, the concentration courses are held through face to face classes in semester 2, aligned with choosing a research/thesis topic that is relevant to the concentration.

In addition to offering concentration courses, there are compulsory courses for all students with a load of 15 credits. These courses are offered in semester 1.

The 15 credits compulsory courses are:

- Seminar on Financial Accounting (3 credits)

- Seminar on Management Accounting (3 credits)

- Seminar on Auditing (3 credits)

- Ethics in Business & Accounting (2 credits)

- Accounting Research Methodology (3 credits)

- Scientific Writing (1 credit).

Subjects 1-3 are required to be taken in order for the students to have the relevant knowledge of accounting needed for all concentrations. These subjects cover all relevant accounting fields that will be neccessary for graduates planning to work in companies, in government, or in a Sharia-based entity. The ethics course is required in order for students to understand the characteristics of ethical business as well as the code of ethics for accountants. Research methodology courses allow students to have an understanding of the rules of scientific research. Research methodology courses are delivered on the 1rd semester to allow students to conduct research in semester 2 and develop a sufficient thesis.

Under the old curricula, the concentration courses were held through face to face classes in semester 2 and 3, followed by choosing a research/thesis topic that is relevant to the concentration. In addition to offering concentration courses, the curriculum has compulsory courses for all students with a load of 15 credits. These courses are offered in semester 1, 2 and 3.The 15 credits compulsory courses consist of:

- Management Accounting Seminar (3 credits)

- Accounting Information System (3 credits)

- Seminar on Taxation (3 credits)

- Seminar on Government Accounting (3 credits)

- Philosophy of Science Accounting (2 credits)

- Ethics in Accounting (3 credits)

- Research Methodology (3 credits).

Subjects 1-4 are required to be taken in order for the students to have the relevant knowledge of accounting needed for all concentrations. Accounting information systems, managerial accounting, taxation, and public sector accounting are the fields that will be neccessary for graduates planning to work in companies, in government, or in a Sharia-based entity. The course in philosophy is required to be taken with the aim to improve students’ ability to think more comprehensively about the science of accounting. The ethics course is required in order for students to understand the characteristics of ethical business as well as the code of ethics for accountants. Research methodology courses allow students to have an understanding of the rules of scientific research. Research methodology courses are delivered in the 3rd semester to allow students to conduct research and develop a sufficient thesis.

Under new curricula, at the 2nd semester each student will follow their choice of concentration classes. The objective of each specialization or concentration and its specialized courses is as follows.

1. Financial Reporting

The objective of this specialization is to provide students with the ability to apply financial accounting. Students are introduced to accounting standards and learn to make decisions based on them. This concentration is offered to students who are interested in careers or have previously worked in a company as a controller, or as an expert consultant in the preparation of financial statements, establishment of accounting policies and other relevant roles.

Students of this specialization must take 5 offered specialization courses, namely:

| 1) Corporate Reporting | 3 credits |

| 2) Business Analysis Based on Financial Statement | 3 credits |

| 3) Contemporary Issues of Accounting Research | 3 credits |

| 4) Financial Management & Valuation Techniques | 3 credits |

| 5) Governance & Integrated Risk Management | 2 credits |

2. Governmental Accounting

In this specialization, students learn to critically think about issues and problems in governmental sector, including government reporting system, planning system, supervision system, public financial management, governmental risk management and other relevant topics. Students of this specialization must take 5 courses, namely:

| 1) Seminar on Accounting in Public Sector | 3 credits |

| 2) Governmental Accounting | 3 credits |

| 3) Governmental Financial Management System | 3 credits |

| 4) Public Sector Auditing | 3 credits |

| 5) Governance & Risk Management for Government | 2 credits |

3. Management Accounting

This specialization focuses on the analysis in the decision making process as the management accountant. Students in this specialization are provided with knowledge on the role of management accounting in a company that enables them to make proper decisions. In addition, Corporate Social Responsibilty is addressed in several of the courses under this concentration. Students of this specialization must take 5 courses, namely:

| 1) Behavioral Aspects in Accounting | 3 credits |

| 2) Strategic Management Accounting | 3 credits |

| 3) Accounting for Decision Making | 3 credits |

| 4) Management Control System | 3 credits |

| 5) Strategic Management | 2 credits |

4. Taxation Accounting

Students who are taking this specialization are expected to be able to do quantitative analysis in order to cope with challenges of tax rules in Indonesia and internationally. Knowledge and skills provided by this specialization are useful in developing the accounting policy. Students of this specialization must take the following 5 courses:

| 1) Theory & Implementation of Taxation | 3 credits |

| 2) Tax Planning Strategies | 3 credits |

| 3) Special Topic in Accounting Taxation | 3 credits |

| 4) Tax Investigations, Inspections and Court | 3 credits |

| 5) International Taxation & Tax Treaty | 2 credits |

5. Accounting Information System

Within this specialization, students learn to analyze and develop business accounting information system for a specific business. Subjects in this concentration include:

| 1) Accounting Information System Seminar | 3 credits |

| 2) Management Information System Seminar | 3 credits |

| 3) Analysis & System Design Methods | 3 credits |

| 4) Decision Support System | 3 credits |

| 5) Expert System | 2 credits |

6. Sharia Accounting

Students who take this specialization are expected to be able to act as accountants in the Islamic business. Students also can gain an understanding regarding accounting for Islamic banking. Subjects in this concentration include:

| 1) Islamic Financial Accounting | 3 credits |

| 2) Accounting for Islamic Bank | 3 credits |

| 3) Special Topics in Islamic Accounting | 3 credits |

| 4) Ethic & Governance for Islamic Institution | 3 credits |

| 5) Islamic Economic & Finance | 2 credits |

7. Auditing

Students who take this specialization are expected to conduct audit, both external and internal. Students also gain an understanding of forensic accounting & investigative audit. Subjects in this concentration include:

| 1) Seminar on Internal Audit | 3 credits |

| 2) Information System Audit | 3 credits |

| 3) Forensic Accounting & Investigative Audit | 3 credits |

| 4) Current Issues in Auditing | 3 credits |

| 5) Public Sector Audit | 2 credits |

8. Accounting science

Students who take this concentration are expected to have knowledge of accounting science related to all kinds of accounting profession, i.e. financial accounting, management accounting, and auditing. Graduates of this specialization are preferred to work as educators. Subjects in this concentration include:

| 1) Seminar on Auditing | 3 credits |

| 2) Seminar on Public Sector Accounting | 3 credits |

| 3) Behavioral Accounting | 3 credits |

| 4) Philosophy of Science | 2 credits |

| 5) Elective Courses/td> | 3 credits |

Under the old curricula, concentrations offered included:

- Auditing and Financial Reporting

- Governmental Accounting

- Management Accounting

- Taxation Accounting

- Information System

- Sharia/Islamic Accounting

- Accounting Science.

The objectives of each specialization or concentration and its specialized courses were as follows:

1. Auditing and Financial Reporting

The objective of this specialization is to provide students with the ability to apply the tools of financial accounting and auditing. Students are introduced to accounting standards and learn to make decisions based on them. This concentration is offered to students who are interested in careers or have previously worked in a company as a controller, internal auditor, or as an external auditor in a public accounting firm.

Students of this specialization must take 7 offered specialization courses: Financial Accounting Seminar; Business Analysis based on Financial Statements; Information System Audit; Audit Internal Seminar; Auditing Seminar; Special Audit; Capital Market Knowledge and Investment Analysis.

2. Governmental Accounting

In this specialization, students learn to critically think about issues and problems in governmental sector, including government reporting system, planning system, supervision system, public financial management, governmental risk management and other relevant topics. Students of this specialization must take 7 courses: Governmental/Public Financial Management; Governmental Accounting Special Topics; Governmental Accounting Information System; Governmental Auditing; Governmental Financial Management System; Governmental Strategic Management;

Governmental Risk Management.

3. Management Accounting

This specialization focuses on the analysis in the decision making process as the management accountant. Students in this specialization are provided with knowledge on the role of management accounting in a company that enables them to make proper decisions. Students of this specialization must take 7 courses: Accounting for Decision Making; Cost Management Seminar; Special Topics in Management Accounting;

Management Control Systems; Behavioral Aspects in Accounting; Strategic Management Accounting; Risk Management Accounting.

4. Taxation Accounting

Students who are taking this specialization are expected to be able to do quantitative analysis in order to cope with challenges of tax rules in Indonesia and internationally. Knowledge and skills provided by this specialization are useful in developing the accounting policy. Students of this specialization must take the following 7 courses: Theory & Implementation of Taxation; Domestic Taxation and Retribution; Capita Selecta Taxation; Tax Planning Strategies; Tax Investigation, Inspection and Collecting; Special Topics in Taxation;

International Taxation & Tax Treaties.

5. Accounting Information System

Within this specialization, students learn to analyze and develop business accounting information system for a specific business. Subjects in this concentration include: Accounting Information System Seminar;

Management Information System Seminar; Analysis & System Design Methods; Database Management System; Software Engineering; Decision Support System; Expert System.

6. Sharia Accounting

Students who take this specialization are expected to be able to act as accountants in the Islamic business. Students also can gain an understanding regarding accounting for Islamic banking. Subjects in this concentration include: Islamic Financial Accounting; Accounting for Islamic Banking; Sharia Accounting Seminar; Ethics & Governance for Islamic Financial Institutions; Special topics in Islamic Accounting; Islamic Capital Market.

4) The School’s Scope of Accreditation

Faculty of Economics and Business (FEB) is one of the biggest faculties in Universitas Padjadjaran. Currently, FEB has 19 study programs ranging from vocational to doctoral. There are 5 vocational (diploma) programs, 4 undergraduate programs, 1 professional program, 6 master programs, and 3 doctoral programs. Out of six master programs, there are 3 programs that have been accredited with an (A) degree from BAN-PT. One of these master programs (i.e Master Program of Management) has been accredited by ABEST21 in 2014.

The scope of the current accreditation will include only one master program: Master of Accounting (MAKSI). MAKSI earned the highest degree (A) accreditation from BAN-PT in 2015. In accordance with vision of FEB and Universitas Padjadjaran, the program would extend its scope of accreditation to international level. The university and the faculty have strong commitment to support the internationalization of their study program.

5) The Peer Review Team

| Leader | Prof. Dr. Gagaring Pagalung Faculty of Economics and Business, Universitas Hasanuddin, Indonesia |

|---|---|

| Member | Prof. Dr. Eko Ganis Sukoharsono Faculty of Economics and Business, Universitas Brawijaya, Indonesia |

| Member | Dr. Noryati Ahmad Arshad Ayub Graduate Business School, Universiti Teknologi MARA, Malaysia |

6) The Peer Review Schedule

| Process | Committee | Date |

|---|---|---|

| Ratification of the Quality Improvement Plan | Peer Review Committee | Nov. 9-10, 2016 |

| Implementation of the Peer Review Visit | Peer Review Team | Sep. 18, 2017 |

| Ratification of the Self-Evaluation Report | Peer Review Committee | Nov. 25-26, 2017 |

| Ratification of the PRT Review Report | Peer Review Committee | Mar. 5, 2018 |

| Recommendation of the ABEST21 Accreditation | Accreditation Committee | Mar. 5, 2018 |

| Ratification of the ABEST21 Accreditation | Board of Trustee | Mar. 6, 2018 |

7) The ABEST21 Peer Review Result

(1) Comprehensive Review

“ABEST21 certifies that the School’s educational and research activities generally satisfy accreditation standards. The School’s KAIZEN plans are good and quality maintenance and prospects for the improvement of education and research are promising and good.”

Generally, all the criteria in the respective Chapters are satisfactorily met by the School. However, there are certain issues that the School needs to address:

- Reexamine the learning goals of the program and clearly link each of the courses to these learning goals

- Address the issue of staff sufficiency. Future planning should focus on reducing the number of SQ and increase the number of AQ.

- Develop alternative financing strategies that ensure the sustainability of the program as well as its ability to achieve its mission statement

- Increase the student diversity, specifically by attracting more foreign students.

(2) The Period of Quality Assurance

Accreditation commences April 1, 2018 for a five-year period. After the accreditation, the School must implement the yearly plan according to its action plan, and respond to the expectations of the social stakeholders. Therefore, the School is required to submit the progress report (KAIZEN Report) by the end of June at the 3rd year after being accredited.

2. Good Practice in Management Education

“Industry-oriented Accounting Education”

PRT members agree that the School’s Industry Engagement practices are commendable.

The School has shown that its curriculum is industry relevant, and has engaged the private and public sectors to be involved not only in giving feedback on the curriculum but also as teaching partners. Through this effort, the School is able to keep abreast with changes in the accounting-related areas, indirectly increase the acceptance of the program by the industry and also bring practical perspective to the program.

3. Matters to be noted

Matters to be noted by the School are:

- The School needs to ensure the sufficiency of faculty members, particularly AQ, since currently the School is relying mostly on PQ faculty members.

- The School needs to look for alternative financing to ensure the sustainability of the program and the School as a whole.

- The School needs to increase student diversity.